In her recent thoughtful and well-researched article for Vice, Shayla Love asked, “Is it possible to create an ethical psychedelics company?” A lot of focus in the psychedelics space over the last few months has centered around the unethical behavior of select companies—David himself has weighed in. Our take is that it’s not only possible to create an ethical psychedelics company, but that such companies already exist. We want to move the discourse towards creating an ethical psychedelics industry as a whole.

As longtime and committed activists in the psychedelic movement, we’ve encountered thoughtful business models and innovative ownership and capitalization structures that, together, present a unique case study on how an industry can move from “extractive capitalism” towards more constructive economic models based on reciprocity, community investment, and trust.

As we envision the future of the industry we want to see, we must first consider who—and what—exactly we are trying to heal with psychedelic medicine. According to the Institute for Health Metrics and Evaluation’s 2017 study, nearly 800 million people worldwide suffer from a mental health issue, roughly one tenth of the global population. When treating these conditions at the individual level, we sometimes miss larger societal issues that are not typically attributed as causative. But this last year has given us no shortage of opportunities to look deeply at the root causes of the mental health crisis, and who is most affected by it.

The protests that rocked the country in the aftermath of the police murder of George Floyd brought about a renewed reckoning with the deep systemic racism and ongoing trauma that Black people, Indigenous people, and people of color face in this country. Indeed, as a report from the American Psychiatric Association revealed, people from racial and ethnic minority groups not only bear a disproportionately high burden of disability resulting from mental disorders, they are less likely to receive mental health care. And when we consider how societal isolation, economic hardship, and racial injustice were all intensified by Covid-19—especially among underserved populations—it’s clear we’re in the midst of another pandemic that is a symptom of an economic system and a society that is wracked with generational trauma and inequality, and is wildly out of balance with nature.

It’s important to acknowledge that the western medical pharmaceutical-driven approach to mental health is deeply and fundamentally inadequate. Conventional pharmaceutical approaches to the mental health crisis largely seek to treat only symptoms, which keeps people dependent on these medications. Moreover, it has failed to truly deliver the healing that people are most in need of which includes the support of nurturing communities and adequate access to education, food, housing, health care, and other basic and essential needs.

Jumping the S-Curve

Because the mainstream application of psychedelics is in its early days and is just beginning to gain a foothold in the broader mental health industry, there is no better time for leaders and investors committed to true healing to push not only for a revolution in the way we treat mental health issues, but also in the way we scale and finance innovation in the mental health industry as a whole.

Why is this transitional stage of an industry’s life so important?

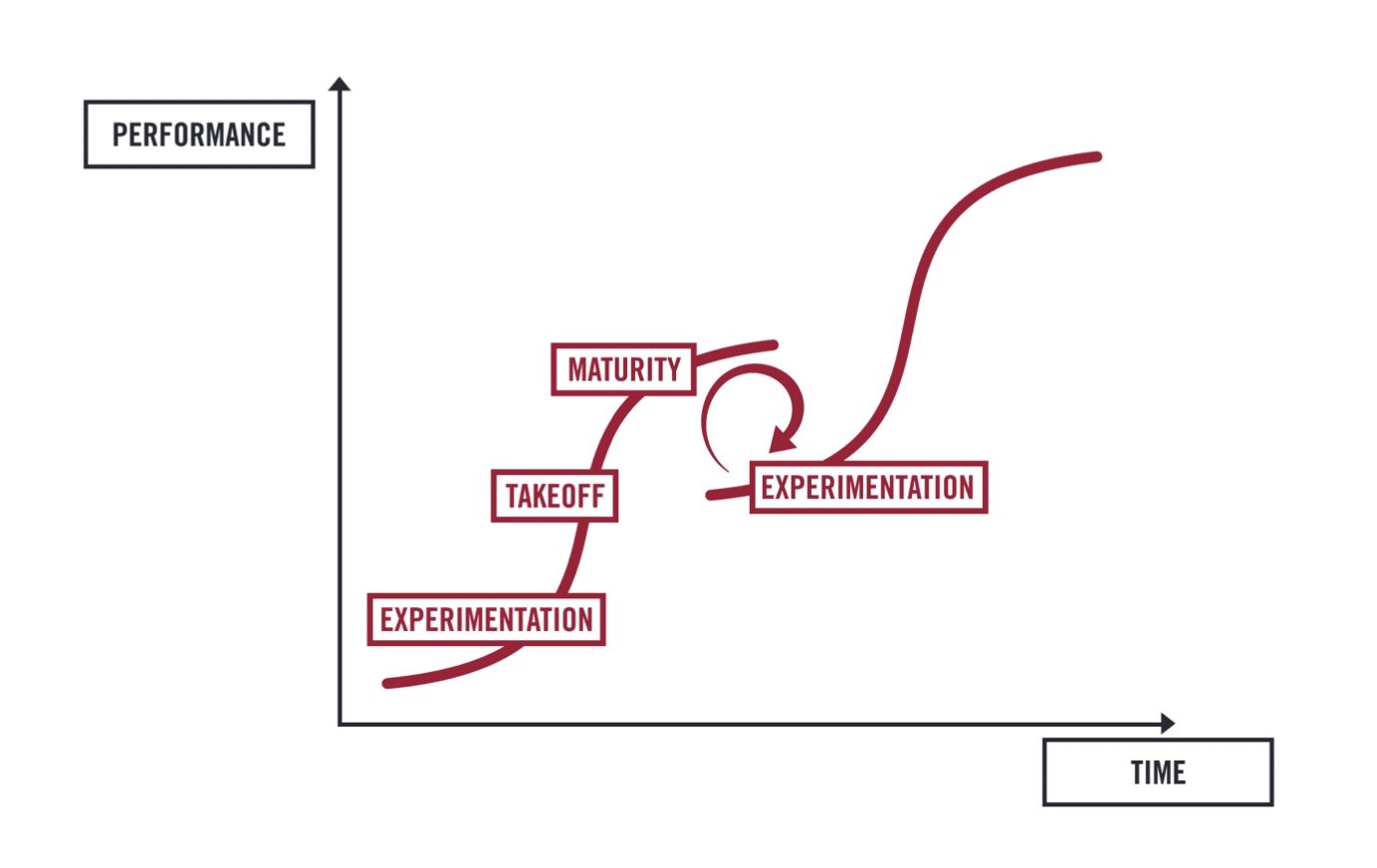

In her online course, Sustainable Business Strategy, Harvard Business School professor Rebecca Henderson helps us understand the kind of innovation that is possible after a mature industry has reached stagnation by referencing the classic framework of an industry’s lifecycle known as the “S-curve.” One can argue the current mental health industry has reached this stagnation, as there has been little innovation in treatment since the introduction of SSRIs in the early eighties. Use of pharmaceutical psychotropic drugs are at an all-time high, but so are pandemic levels of depression, suicide, and PTSD. If these medications were especially effective, we should be seeing a decline in these conditions, but this is not the case.

“In mature industries firms may be at risk of disruption as new technologies and new business models emerge to satisfy customer needs more effectively. Firms that don’t ‘jump’ the S-curve may be left behind by those who adopt the new ways of doing things,” Henderson explains. To jump the curve, Henderson says, “industries and firms begin by experimenting. If they’re lucky or skillful, they discover entirely new ways of doing things.”

We have a unique opportunity in the psychedelics space because not only are firms experimenting with new medicines, but they are also exploring groundbreaking new treatment modalities and business models that are redefining what mental health care delivery looks like.

But Henderson notes another crucial aspect of an industry’s life cycle in today’s operating environment. Historically, businesses have enjoyed free natural and social capital; they have not had to “pay” for the harmful externalities created by shareholder-centric capitalism. Henderson argues this is starting to change as companies are increasingly being held accountable by their customers, employees, and investors.

For a psychedelics company to succeed in the only way that matters—where all stakeholders benefit, including society at large and the natural world—we believe a company must have a model that addresses reciprocity, equitable access, philanthropy, and environmental stewardship. In other words, they must be willing to embark upon a true cost accounting of the positive and negative impacts they create through their business.

The Dr. Bronner’s approach

Dr. Bronner’s interest in the psychedelic space is connected to our founder Emanuel Bronner’s “All-One!” vision to heal the planet. Emanuel firmly believed that true healing could only be achieved by “sharing the profits with the workers and the earth from which you made it.”

That’s why we are such strong advocates of an industry-wide embrace of stakeholder economics, where companies not only answer to investors but also to the Indigenous communities where these medicines originated, individuals and groups who have historically been underserved by the mental health industry, and pioneers in the scientific and psychedelic community who have so willingly shared their knowledge about these life-saving medicines and forms of treatment.

Our interest is also informed by over two decades in both the cannabis and natural products industries—that experience has taught us a great deal about what happens when founders’ visions for a healthier world are thwarted and coopted by extractive forms of capitalism.

Take cannabis. We and our fellow activists devoted so much time and energy fighting for legalization that we didn’t think nearly enough about the kinds of businesses that would develop when the movement won. As a result, the industry is closer in values and practice to the industrial agriculture business model than the movement we’ve been part of for so long. Increasingly we are seeing the effects of the negative externalities of this industry—a massive carbon footprint, harm and disruption to the livelihoods of small-scale farmers, and the proliferation of racial inequity and injustice, to name a few. Unfortunately, the over $5 million dollars Dr. Bronner’s has donated to cannabis reform efforts is a drop in the bucket relative to the private capital that has entered the market.

Our desire to avoid the same mistakes in the psychedelic space led to supporting policies and initiatives that minimize the barriers for entry for smaller players and limit the scale that any single operator can have; for example, Measure 109 in Oregon limits the size of mushroom grows, caps the number of clinics any one operator can own to five, and prohibits branding and marketing of medicine.

Realizing that support of purpose-driven social enterprises is also required, we are now launching Dr. Bronner’s catalytic impact investing initiative this year—a third portfolio of giving sitting alongside our policy and philanthropic work. We believe that, together, these three areas are mutually synergistic and by deploying all three we are in the strongest position to help create true systemic change.

Our catalytic impact investing portfolio

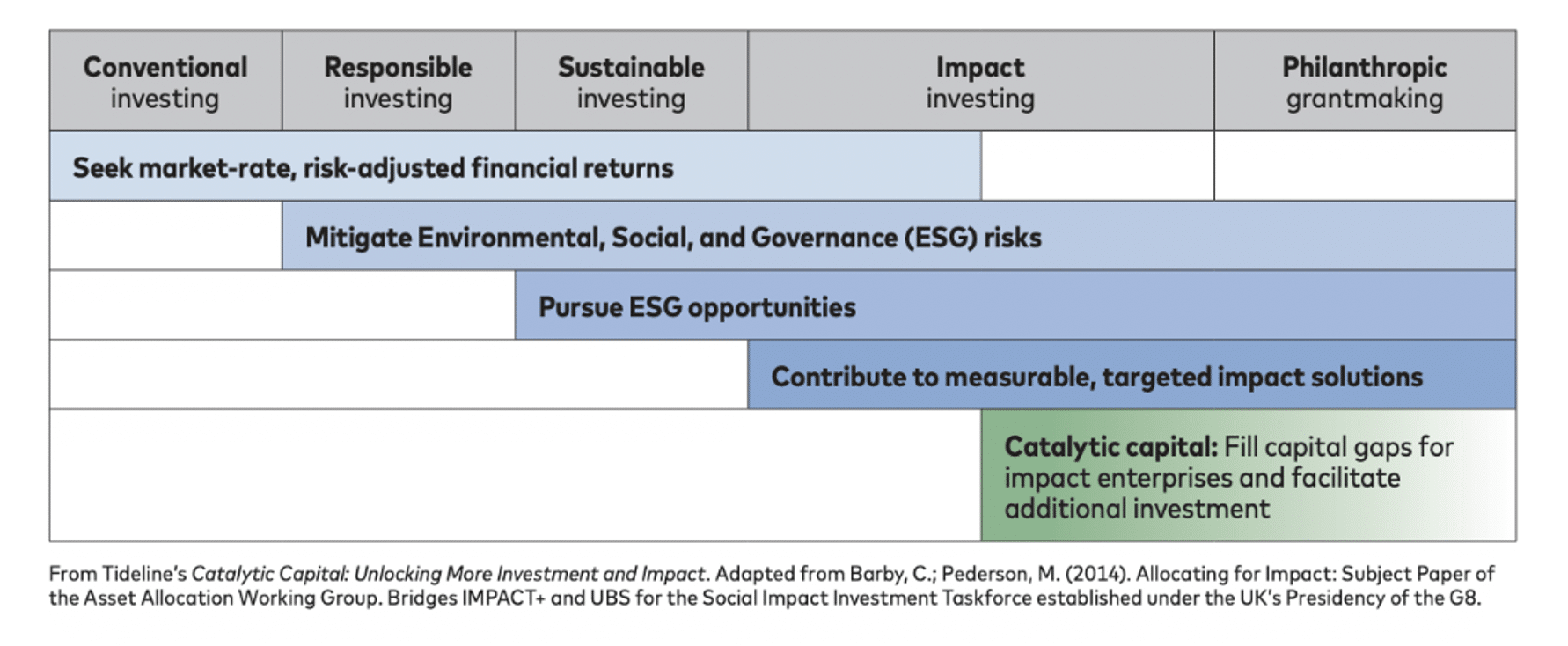

“Catalytic capital” succinctly describes how we intend to engage in impact investing. The MacArthur Foundation and Tideline define catalytic capital as capital that accepts a disproportionate risk or concessionary returns to generate positive impact and enable third-party investment that otherwise would not be possible.

In our interpretation of this catalytic—or “impact first”—model, we include grant capital and are open to investing in both for-profit and nonprofit entities. The way we distinguish a catalytic investment from a purely philanthropic donation is that the enterprise is or has the potential to be a revenue-generating and financially self-sustaining social enterprise. Our investments will be made through a nonprofit fund that we are setting up, where any returns are then cycled back into philanthropy, activism, or further catalytic impact investing.

In many ways, this initiative is a natural offshoot of the work we’ve been doing around regenerative organic agriculture around the world, which Dr. Bronner’s Vice President of Special Operations, Gero Leson, documents in his new book Honor Thy Label: Dr. Bronner’s Unconventional Journey to a Clean, Green, and Ethical Supply Chain. From our experience investing in fair trade projects that supply our raw materials, we’ve watched how the way capital is raised—and from whom it’s raised—in many ways determines whether one can properly execute on their mission, purpose, and strategy.

All too often, investor pressure forces visionary founders to make concessions they wouldn’t have to make with a more innovative financing structure; that’s why the natural food and products space is littered with stories about well-intentioned entrepreneurs that either drifted from their core mission or were pushed out of power because of lack of alignment with capital providers. (The recent ouster of Danone’s leader Emmanuel Faber under pressure from activist shareholders is just one example.)

Our investments are typically seed investments, in early-stage enterprises with innovative business models, a strategy influenced by the Omidyar Network’s report Across the Returns Continuum. Our focus is to support transformative business models that will lay the infrastructure for the industry we want to see—one that actually reflects the values that informed the psychedelic movement to begin with and made its growth possible. Specifically, this includes medicine providers, clinics, therapist training, ancillary services such as health insurance, high quality patient and practitioner education, culturally competent healers, and healing centers reflective of their communities.

For a number of years now, we’ve effectively engaged in this kind of catalytic “investing” with our philanthropic giving to MAPS, along with other donors, to effectively finance their startup costs in their work to commercialize MDMA for treating PTSD. The success of this project will allow MAPS to be able to generate profits and exponentially scale their impact on mass mental health while helping to end the drug war.

The primary goal of our support for MAPS’s project to bring MDMA through the FDA approval process has been to generate the clinical trials that will destigmatize the culture to the point that campaigns like Oregon’s psilocybin therapy measure, alongside the various decriminalization campaigns, can succeed in opening up legal protection and space for all adults to safely access psychedelic medicines outside of the conventional medical pharmaceutical framework. This is also the primary goal of MAPS: to move society towards a post-prohibition future where addiction is treated as a health issue rather than a criminal issue, and where psychedelic therapy and medicine is widely available and accessible for all.

MAPS has a two-tiered ownership structure where MAPS Public Benefit Corporation is a 100%-owned subsidiary of a 501c3 public charity. This is reflective of a larger movement to alternative ownership structures where a commercial operation is owned by a nonprofit or a trust entity. In these cases, the beneficiary is the mission of the organization rather than shareholders.

Another longtime partner utilizing a nonprofit structure is Usona Institute, which has focused attention on getting approval for psylocibin as a treatment for depression. It’s interesting to note that MAPS and Usona are two of the organizations furthest along in terms of drug commercialization efforts, and both have adopted alternative or ‘steward’ ownership structures. Between the two of them they have raised over $150 million.

Health equity, open science, and reciprocity

While the enterprises we’re investing in are exploring different ownership structures and areas of focus, common themes can be found in their commitment to health equity, open science, the creation of mutually beneficial relationships with Indigenous communities, and sustainable environmental practices.

Many of our catalytic impact investments are in enterprises that focus on making mental health treatment accessible to systemically disenfranchised and traumatized populations. With their commitment to health equity, the Alchemy Community Therapy Center offers a sliding scale cost for ketamine therapy that brings the cost down to as low as one tenth of market rate; they also hope to provide a model for other like-minded clinics, choosing to partner with others in their area to share information and learnings. Meanwhile, Enthea, whose mission is to provide safe affordable access to psychedelic therapies for all who can benefit, is tackling the challenge of access by expediting health insurance coverage for psychedelic treatments, and developing payment technology to optimize reach of multiple patient funding sources. MAPS has also recently launched a $5.4 million Health Equity program that prioritizes both MDMA treatment and training access for Black, Indigenous, and other therapists and patients of color, as well as patients and therapists who are transgender or gender non-binary.

A commitment to open science is another hallmark of the ethical enterprises in this space. The Usona Institute provides investigational drugs and materials at no cost to academic researchers as part of their commitment to open science. The public benefit corporation, Mimosa Therapeutics is another inspiring model, committed to open science publishing, support for species conservation, Indigenous and local community support, and growing a diverse team. Mimosa is oriented around democratizing access to psychedelics by offering lower cost sacraments, supplements, topicals as well as cost-effective tools to “grow your own” psychedelic mushrooms at individual, small group, and large group scales.

Another crucial aspect of ethics in the industry is acknowledging, learning from, and reciprocating with the Indigenous communities from which psychedelic medicines are ultimately derived. While it’s possible for psychedelic pharma companies to deliver therapies that are culturally appropriate, equitable, and accessible to people in the throes of acute mental health crises, psychedelic medicines also need to be available in healing circles, churches, and other respected community organizations outside of the medical pharmaceutical framework, just as they are in the Indigenous communities from which these medicines and therapies ultimately originate.

The mutual support and aid that healing communities like the Native American Church and Santo Daime provide their members on an ongoing and lifelong basis can’t be overestimated. This approach is far more effective than single or few dose psychedelic therapy sessions that often lack supportive community and long-term aftercare.

We believe that ethical companies must also dedicate resources to enabling policies that liberate communities and allow them to heal in this way and ensure that indigenous communities first and foremost can benefit from the psychedelic renaissance. Recognizing this crucial responsibility, The Temple of the Way of Light donates 100% of the profits of their ayahuasca retreats into ecological and social projects in the Amazon and beyond. And the Center for Consciousness Medicine, a nonprofit committed to training psychedelic guides, has created accessibility and reciprocity funds, a percentage of which go directly to a group of trusted Mazatec leaders who will decide how they wish for their community to be supported by the fund.

When discussing their mission, our friends at The Temple of The Way of Light put it like this: “We operate within Akinananti, an Indigenous (Shipibo) expression for reciprocity and interdependence, the central principle that guides all aspects of a harmonious society… Living by Akinananti, we deeply understand the importance of giving back through the circulation of energy, goods, knowledge, and labor for the benefit of family, society, culture, and the environment.”

We believe that every enterprise that operates in the psychedelics space must accept the same level of responsibility for this sacred medicine in order to truly achieve its healing potential. Along with our partners at the nonprofit Riverstyx Foundation and Indigenous stakeholders, we’re helping set up the Indigenous Medicine Conservation Fund, that will identify and support Indigenous-led biocultural preservation projects. The Chacruna Institute for Psychedelic Plant Medicine, an organization committed to bridging the gap between the world of plant medicines and psychedelic science, has also launched their own Indigenous Reciprocity Initiative.

What we know as a mission-driven company

It is important that mission-driven companies understand their cost margin structures and can adopt a pricing strategy from the get-go that enables significant use of company resources—financial, staff and otherwise—not just towards the company’s continued growth, but also to benefit all stakeholders. Such socially-focused activity may not be strictly related to generating profit or revenue but often generates customer awareness and goodwill, which drives topline growth.

This has certainly been true for Dr. Bronner’s, where over the past ten years on average we’ve been able to dedicate approximately 45% of our pre-tax, pre-contribution profit—about 7.5% of our net revenue—to the charities, campaigns, and causes we believe in.

We have written this article to address the power, utility, and potential of impact-driven catalytic capital infusions into mission-driven social ventures. At the same time we hold that our donations to progressive ballot campaigns like Decriminalize Denver, Decriminalize Nature in DC, and Oregon’s 109 and 110 campaigns that legalized psilocybin therapy and decriminalized all drugs, as well as our support of various charities working in the psychedelic space, such as the Indigenous Peyote Conservation Initiative, Veterans Exploring Treatment Solutions (VETS), and Heroic Hearts Project, have made some of the biggest impact in our mission to advance the integration of psychedelic medicines in the world.

Some of the investments we’ve mentioned thus far are set up as nonprofits and others are for-profits using innovative financing structures. Our preference is Revenue Based Financing (RBF). RBF is a hybrid of debt and equity where enterprise promises a percentage of their top-line revenue until a certain fixed amount is paid back or a certain Internal Rate of Return (IRR) is achieved. This approach offers the greatest flexibility to entrepreneurs and provides an impact loan where the lender or investor is not concerned with ownership or maximizing returns, but simply wants to help catalyze a mission-driven venture to succeed.

It’s worth noting that tension can be created if an enterprise was seeded with catalytic and philanthropic capital but then, in order to scale, begins to consider more conventional sources of financing. Ultimately, enterprises have to take the same care in choosing investors as choosing employees, customers, suppliers, and other stakeholders.

Two funds focused on the psychedelic industry are Vine, which gives 50% of their carried interest to philanthropy, and Integrated, a venture fund that allocates a significant portion of its profits to the nonprofit Reconsider. Reconsider is focused on convening leaders in the field, catalyzing conversations, and creating media and educational programs that promote the integration of psychedelics and complementary therapies.

We see the rise of firms like Vine and Integrated as a sign of a greater trend towards catalytic investing. As Bridgespan’s latest report discusses, never before has there been this volume of socially-responsible investing. But there is still a long way to go: The Global Impact Investing Network (GIIN) reports that impact investors responding to its survey deployed only $3.5 billion in catalytic capital in 2019—7.5 percent of the $47 billion in new impact investments made that year. Luckily, more options exist than ever for entrepreneurs to find purpose-aligned capital. Our hope is to build bridges between this larger impact investing community, and the purpose-led psychedelic companies looking for values-aligned capital providers.

While the initiatives in our catalytic impact investing portfolio that we discussed above are just a surface-level glimpse at some of the ethical business approaches in the psychedelics industry, we believe that together, they can pave the way for a mental health industry that benefits people and planet—instead of unconsciously participating in and perpetuating systemic inequity and environmental devastation that is making us so collectively sick and out of balance in the first place.

Although there is much we are alarmed about in the bourgeoning psychedelics space, we are at the same time deeply inspired by the ways the entrepreneurs and community leaders we are supporting are helping to prefigure what an ethical industry can look like. Those of us who believe in the healing and transformative power of psychedelics can use their work as a foundation to help build a psychedelics industry—and the next generation of mental health solutions—in service to a truly just, sustainable, and equitable world.